Pennsylvania offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Pennsylvania Alternative and Clean Energy Program (ACE)

FirstEnergy Corp.

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Pennsylvania State Capitol

501 N 3rd St, Harrisburg, PA 17120

(800) 868-7672

[email protected]

Monday-Friday, 7:00 a.m. – 6:00 p.m.

PECO Energy Company

2301 Market St.

Philadelphia, PA 19103

(800) 494-4000

(800) 841-4141

(844) 841-4151

Pennsylvania Department of Environmental Protection – Energy Programs Office

400 Market Street

Harrisburg, PA 17101

(717) 705-0374

[email protected]

Monday-Friday, 7:00 a.m. – 6:00 p.m.

Philadelphia/Mt Holly Weather Bureau

732 Woodlane Rd.

Mount Holly, NJ 08060

(609) 261-6600

[email protected]

Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

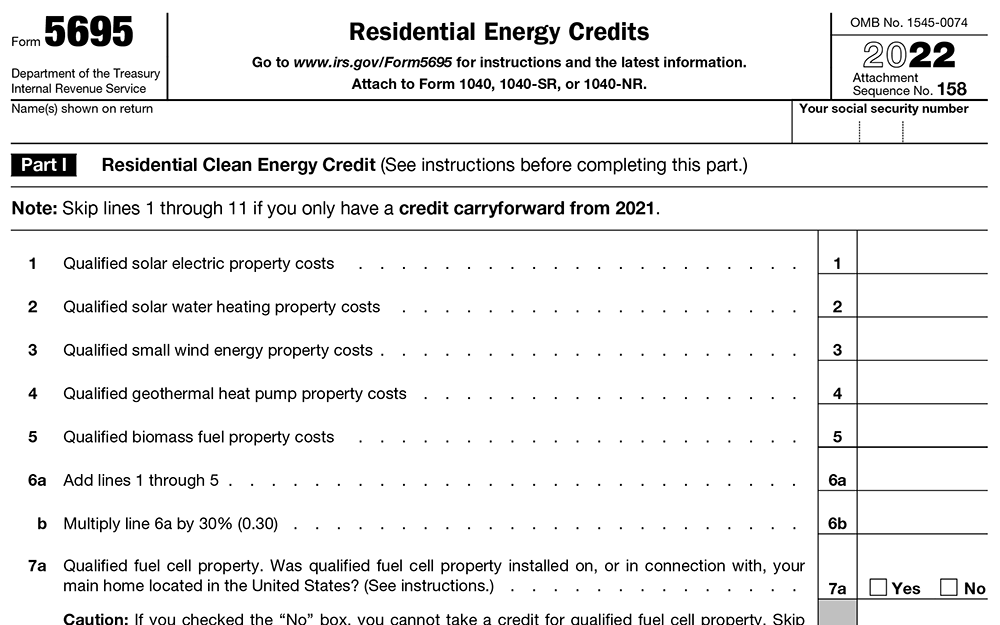

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Pennsylvania Clean Energy

Grants, Loans and Rebates

Incentives

Rebates & Discounts

DEP Alternative Fuel Vehicle Rebates

Power Outage Map

Department of Environmental Protection

Phone: 412-442-4000

Email: [email protected]

Monday – Friday

8 AM – 4 PM

Southwest Regional Office

400 Waterfront Drive

Pittsburgh, PA 15222

Pennsylvania, a state with a rich history in fossil fuel production, now offers federal and Pennsylvania solar incentives to make solar power more accessible and affordable for residents.

Pennsylvania Solar Energy Overview

Interestingly, even though the Keystone State is among the top 5 fossil fuel-producing states in the country,14 electricity prices here are higher than the national average standing at 18 cents per kilowatt-hour.13 As a person looking to switch to solar, this presents you with an added incentive.

Additionally, by enrolling in PA renewable energy programs and installing solar in your home with the help of Pennsylvania solar incentives, you not only gain control over your electricity costs but also contribute positively towards environmental sustainability.

The state has implemented various programs aimed at incentivizing homeowners to go solar, including federal tax credits, solar renewable energy certificates, state-wide net metering policies, and power purchasing agreements among other local programs. For people who are intimidated by the huge upfront investment associated with solar, now is the perfect time for you to switch.

This guide provides you with key details on all credits and incentives available for going solar in Pennsylvania with their eligibility and application requirements, your estimated system costs, and step-by-step instructions for installing solar panels to maximize available incentives.

Solar Credits That Apply in Pennsylvania

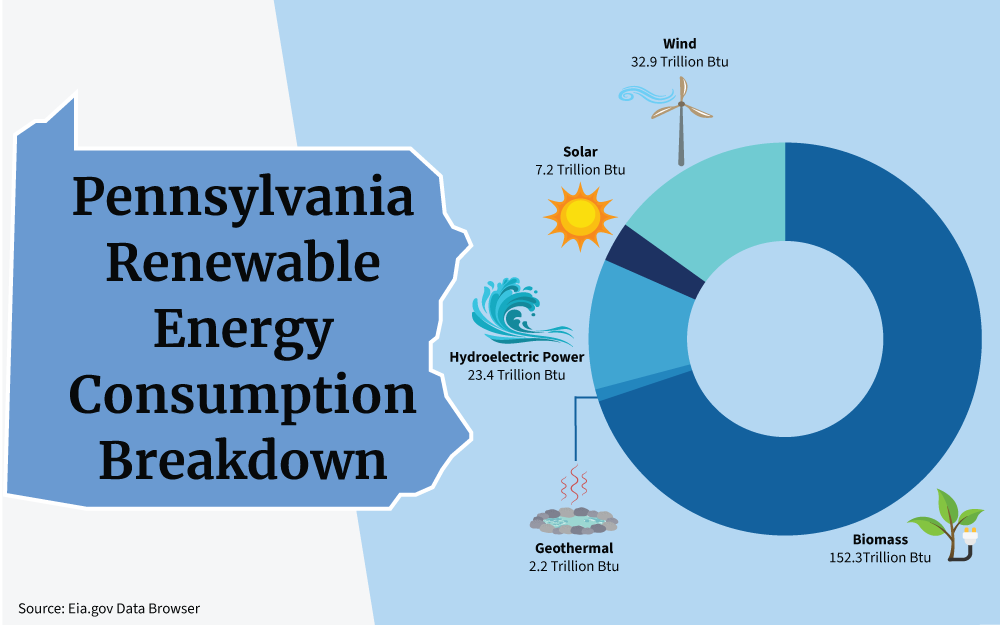

Currently, solar power is the second lowest form of renewable energy that is being utilized in the state of Pennsylvania. A few of the things that deter most people from it are probably accessibility and cost.

So, to encourage residents to finally go solar, different programs that incentivize the installation of a home solar system are being offered both by the federal and state governments.

Solar tax credits and incentives can significantly reduce your cost of installing solar panels in Pennsylvania. The main solar credits available include the federal Investment Tax Credit (ITC) and Pennsylvania’s Solar Renewable Energy Certificates (SRECs) program.

Federal Solar Investment Tax Credit (ITC)

The biggest solar incentive you will come across in the entire U.S. is the Federal Investment Tax Credit (ITC).12 This program offers you a tax credit equal to 30% of the total cost of purchasing and installing a solar energy system on your home before December 31, 2032.

As an example, if you spend $18,000 to install solar system for your home, you can claim a $5,400 tax credit which reduces your federal income taxes owed for that year. This means that you save 30% right off the bat on your solar panel system!

To qualify for the full 30% tax credit, you must own the solar panel system directly rather than leasing or signing a power purchase agreement. The home must also be your primary or secondary residence, not a rental property.

But otherwise, most homeowners in PA are eligible for this valuable incentive which significantly reduces the net out-of-pocket costs of going solar.

You can claim the credit when filing your taxes for the year by submitting IRS Form 5695 along with documentation of your total solar installation costs.2 This includes costs incurred on parts, permitting fees, labor, taxes, and anything related to the system installation.

You’ll need to submit these invoices, receipts, and other paperwork as proof when claiming the credits. Any tax credits exceeding your outstanding tax obligations are rolled over year-to-year for up to 5 years.

Pennsylvania Solar Renewable Energy Certificates (SRECs)

While an exclusive Pennsylvania solar tax credit doesn’t exist, the state government still offers a state-level solar incentive through its Solar Renewable Energy Certificate (SREC) program. This program allows you to earn one SREC for every 1,000 kWh of electricity that your system produces annually.

After earning SRECs, you can then sell them on the open market to utility companies and electricity suppliers in Pennsylvania. Pennsylvania state law, through the Pennsylvania Alternative Energy Portfolio Standard (AEPS),7 requires suppliers to meet renewable energy standards. As such they are very eager to purchase your SRECs to fulfill their compliance requirements.

The sale price per SREC varies with market conditions but it tends to range from $30 to $50 each in Pennsylvania ($46 and $48 in recent months). For a typical 6-kW rooftop solar array producing around 8,000 kWh per year, that comes to around 8 SRECs annually. With a going price of $46 per credit, SRECs can provide you with an extra $368 annually.

To participate in the Pennsylvania SREC program, you need to do the following;

- Register your solar system in the PJM Environmental Information Services Generation Attribute Tracking System (GATS).10 Note that you will need to submit an application fee of $50 plus ongoing annual fees.

- Once approved as a qualified solar facility, you will receive a unique GATS identification number for your system which allows you to begin registering SRECs.

- You then need to list your SRECs for sale on the GATS trading platform. You can also opt to have brokers list them on your behalf for an additional fee.

- Finally, complete the sale of your SRECs to local utility companies or other buyers and earn extra money from your solar system.

ITC Tax Credit Options

In addition to the federal solar tax credit, you can also take advantage of the following state and local solar incentives:

Philadelphia Solar Rebate Program

The Philadelphia Solar Rebate Program issues you with a one-time payment of $0.20 per watt of the installed solar capacity in your home.8 For example, if you have a 6-kilowatt system, you qualify for a $1,200 rebate.

However, the program was suspended in 2020 and has not yet reopened. Check the Philadelphia Energy Authority’s solar rebate page for updates.

The Philadelphia Energy Authority (PEA) will issue the rebate to those who have already signed up. Therefore, apply for the rebate immediately after your solar panels have been installed and received Permission to Operate.

Homeowners Energy Efficiency Loan Program (HEELP)

HEELP provides low-interest loans to fund energy efficiency improvements for Pennsylvania homeowners.6 You can access loans from $1,000 to $10,000 at 1% APR. Solar installations are one eligible use of this loan.

HEELP loans have flexible 10-year terms with no prepayment penalties. However, you need to meet certain income qualifications in order to be eligible for the loan: below the annual income of $53,450 for a single individual and $100,800 for a household of eight individuals.

Pennsylvania Sunshine Program

The PA Sunshine Program offers rebates to encourage residents to switch to solar.4 As a homeowner, you are eligible for rebates up to $5,000 for systems up to 10 kilowatts in size. However, you can only combine this rebate with ITC only and no other rebates or subsidies.

This is a control measure designed to avoid double dipping.5 Unfortunately, the program is currently not accepting applications as funds are expected to run out before the end of 2023. Be sure to check for updates on when additional funding could become available.

Solarize Philly

The Solarize Philly program aims to encourage solar adoption in the city of Philadelphia by providing discounted pricing through group purchasing.9

Initiated through the Philadelphia Energy Authority (PEA), the program negotiates rates in advance with local installers. As a homeowner, this gives you access to competitive prices and consumer protections built into standardized contracts that offer high-quality equipment standards and suitable warranties.

Low-to-medium-income households can also qualify for additional “Solar Savings” grants to reduce their solar installation costs further. While also on hold due to lack of funding, Solarize Philly plans to reopen enrollment once additional grants become available.

If your question is, “what are the limits on the solar tax credits and rebates?” it is recommended to check each program on their official government websites for the specific guidelines.

Leveraging federal, state, and local solar incentives can help you maximize savings. Consult your solar installers to determine which credits and rebates apply to your specific situation.

What Is Needed To Qualify for Solar Credits?

Want to score every solar incentive out there? To take full advantage of all available solar incentives, your system and application must meet certain eligibility conditions:

Ownership

First, you must directly purchase and own the solar system for home energy usage.12 This can be either with cash or a solar loan so as to qualify for the federal tax credit. Solar leases and power purchase agreements (PPAs) unfortunately don’t meet ownership requirements. Additionally, the home must be your primary or secondary residence-rental properties don’t qualify.

Deadlines

For the 30% federal solar tax credit, your system specifically needs to be installed and operational from January 01 2022 to December 31, 2032. You can claim this credit by filing IRS Form 5695 along with your tax return for the year the system goes live.

To get state SRECs and incentives, submit your applications before program deadlines and provide any utility-requested documentation like signed interconnection forms. Net metering requires you to contact your utility provider in advance and submit an application to connect your self-owned system to the grid.

Certifications

When purchasing system equipment, ensure your solar panels and inverters have UL, ETL, or FCC certification. This validates that they meet safety and performance standards. The Energy Star label also verifies efficient solar components.

Documentation

Throughout the process, maintain detailed records of all costs incurred. This includes costs incurred on parts, permitting fees, labor, taxes, and anything related to the system installation. You’ll need to submit these invoices, receipts, and other paperwork as proof when claiming credits.

Work closely with your installer to submit proper documentation and applications to qualify for incentives like the federal tax credit, SRECs, and net metering. Meeting all requirements ensures you earn the maximum solar credits and savings available to Pennsylvania homeowners.

Taxes Due

Most solar credits only apply to the taxes you owe to the government. It reduces the amount you have to pay for your income tax liabilities in the year the solar panel installation is completed.

In case your income tax that year is less than the solar credit you have gained, it can be rolled over to the next fiscal year.

But is there a deadline for applying for tax credits?

The legislation for this program expires on December 31, 2034, but solar PV systems installed from January 1, 2017 to that date are all eligible.

Does Pennsylvania Offer Net Metering and Power Purchasing Agreements (PPA)?

Yes. Pennsylvania does have statewide net metering and power purchase agreements available to homeowners who wish to go solar. These arrangements can greatly help you maximize the financial benefits of your solar system over time.

Net Metering

Net metering is one of the longest-standing solar incentives in the Keystone State: 15 years and counting. It’s essentially a “solar recovery” program that only works if you have a solar panel grid connection.

With net metering, any extra solar energy your self-owned solar panels produce on a system with a capacity of up to 50 kW gets fed back into the electric grid. You are then billed based on your net energy usage within each billing period.

If you produce more energy than you need, you accumulate a 1:1 kWh credit on your electricity bills. So, on sunny days when your solar system generates more than you need, you can bank those kilowatt-hour credits to offset your grid energy usage at night or on cloudy days.

This helps offset costs and maximize solar savings.

The value of these credits depends on your particular utility’s net metering policy, but it’s typically around the normal retail electricity rate.

So, if in one month your panels generate more solar electricity than you use, your bill can go negative! Those credits will be applied to the next month’s bill.

Over time as the credits accumulate, you end up paying less and less to the utility. Any excess credits also roll over from year to year. All investor-owned utilities in PA are required to offer net metering. However, the energy generated by your system should not be more than 110% of your anticipated energy consumption.

Enrollment requirements vary across different utility companies in Pennsylvania despite having a statewide net metering policy.7 Therefore, be sure to check with your utility company for the specific requirements you need to enroll.

Power Purchase Agreements (PPAs)

The upfront cost associated with solar systems inhibits most people from switching to solar. A power purchase agreement (PPA) provides you with the opportunity to switch to solar without any upfront installation expenses. A solar company handles everything including equipment, permits, and labor.

They own the system on your property while you pay a fixed, discounted rate for the power produced, which is usually lower than what you currently pay for utility services.

The catch is you don’t own the system. As such, you miss out on tax credits and incentives. Additionally, you’re locked into a contract with the solar provider that spans 15 to 25 years.

That said, if you just want affordable solar without any initial spending, PPAs are great. Though purchasing with cash or a solar loan often yields better long-term savings – especially when you combine the federal tax credit with net metering.

Either way, over the years the energy bill savings can add up compared to expensive old utility electricity. So, whether you buy or lease solar, you’ll save big money by harnessing the sun’s power! Just consider all options to pick what best fits your home and budget.

What Materials and Parts Do You Need for Solar Panel Systems?

Going solar is a major investment, easily the priciest project after building the home itself. As such, understanding the key components of a solar system and the associated costs will help you estimate your total expected expenditure.

Solar Panels

This is the most obvious thing that comes to mind when you think about a solar system. Understandably, solar panels alone makeup about 40% of the total expense.

But why is it so expensive? What is solar panel made of?

Solar panels are made of a special type of technology that allows the conversion of sunlight into electricity. A solar panel or solar module consists of several photovoltaic cells (PV cells) that capture photons, more commonly known as light particles, to create an electric current.

Additionally, there is no such thing as electric solar panels; the panels produce electricity, but they are not run by it.

Most homes choose a monocrystalline or polycrystalline silicon solar panel which are rated around 300+ watts each. A solar panel lifespan usually lasts a solid 25-30 years. You can expect to pay between $2 and $4 per watt based on efficiency, brand, and type.

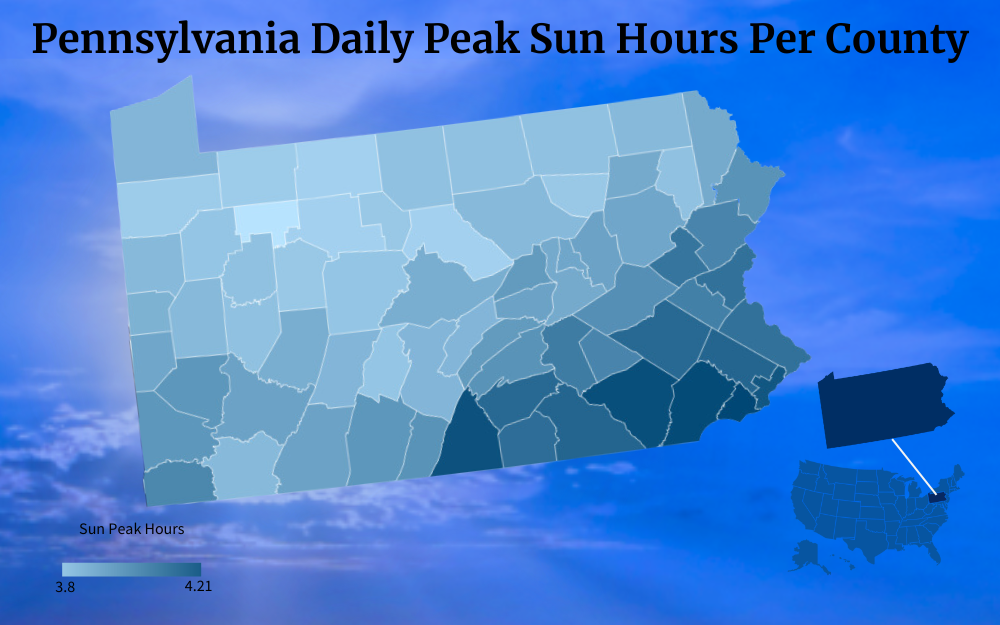

Since sunlight is the main thing needed by the system, it might also do you good to know your location’s peak sun hours, or to put it simply, how much sunlight your place receives that can be converted into energy.

If you’re wondering how long can solar panels last without sun, the panels themselves would remain functional even on cloudy days or partial shade, just as long as there is daylight.

Inverter

You’ll also need a quality inverter to turn the DC electricity from the panels into usable AC power. Having microinverters on each panel optimizes energy harvest while central string inverters cost less but provide less performance data.

Depending on your choice, plan on spending around $0.20-$0.40 per watt of your system size on inverters.

Mounting Equipment

A rooftop solar requires sturdy mounting hardware to secure the panels. Rail-based racks or flush-integrated mounts work best for pitched roofs. On the other hand, flat roof systems may need ballasts or penetration attachments.

Proper mounts will last for decades on your home. Residential mounting averages $1-$3 per watt which comes to $1,000-$2,000 for a standard 6 kW system.

Electrical Accessories

Don’t forget cables, conduits, combiners, and other electrical gear to wire up the solar components into a cohesive home solar energy system.

This equipment enables efficient power transfer and safety. Total costs for wiring and conduit typically range from $1,000 to $2,000 for a full home solar installation.

Monitoring System

Although this is optional, a monitoring system lets you track real-time production, lifetime savings, and system performance. This can help you determine if you need to make any changes to the system.

Basic monitoring will cost you around $500 to $1,500 plus data fees. Advanced systems with live panel-level monitoring can cost more but provide greater insight.

For an average Pennsylvania home, you need a 6-kW solar system. With all those components factored in, you can expect to spend $18,000 to $22,000 before incentives.1 This translates to an average $3.02 cost per watt. The 30 percent federal tax credit can then reduce this cost by $5,000 to $6,600.

Solar Installation Calculator Costs

Using an accurate solar calculator is a great way to estimate the number of panels you’ll need, how much energy they can produce, and your potential cost savings in Pennsylvania.

Quality solar calculators explain their methodology and allow you to adjust variables to optimize financial outcomes.

When you enter your address, the calculator will consider factors like:

- Your location in PA: Since electricity rates can vary across different utility companies in the state, this impacts the savings you could achieve in your area.

- Desired system size: Based on the energy needs and average monthly electricity usage of your household, the calculator can determine how many solar panels and watts your system requires.

- Panel efficiency: Higher efficiency solar panels will produce more power, but they typically come with a higher price tag. The calculator will account for this.

- Your roof type: If your roof is steeply sloped, flat, or has a complex layout, it often costs more to outfit it than if the pitch and placement of your roof allow you to maximize sunlight without costly materials.

- Sun exposure: Solar panels require direct, unshaded sunlight, so preferably your roof area faces south. The calculator also considers roof orientation and sunlight hours.

- Your savings goals: Based on the system size and your electricity costs, the calculator can estimate payback time and return on investment.

The calculator first determines the right system size based on your average monthly power usage. It then estimates annual energy production based on panel specs, roof orientation, and local weather patterns. Finally, it calculates potential utility bill savings based on your rates.

Using a solar calculator early on helps determine if solar power can provide long-term savings for your Pennsylvania home. Look for a user-friendly calculator that lets you adjust variables like equipment and incentives to find the optimal system configuration and pricing.

How To Find PA Solar Panels

Installing a solar energy system is a major home improvement project. With hundreds of solar companies operating in Pennsylvania, it can be difficult to know how to go about your search.

Here are a few tips to help you find reputable local installers and purchase high-quality solar equipment:11

- Check Reviews and Referrals. Talk to neighbors and check online reviews for local installer recommendations. Word-of-mouth references help pre-screen qualified solar firms. Search the company name online along with “reviews” and “complaints” to view feedback from past customers.

- Consider Company Experience. Setting up solar panels is not something just anyone can do. You have to look for established PA companies with longevity in the solar industry. Ask about how long the company has been in business and how many solar installations they have completed in PA. Be cautious of new or out-of-state firms.

- Compare Multiple Quotes. Get quotes from 3-5 installers to compare the costs for your specific home and energy needs in Pennsylvania. This should also include project timelines. Solar installation for a 6-kW system generally takes 2-3 days with another 1-2 days for inspections.

- Verify Credentials. Ask installers about their licensing, insurance, training, and industry affiliations to ensure solar expertise. Licensed electricians are ideal. NABCEP certification is the gold standard for solar installers.3 Licensed electricians should also be involved. The contractor should also carry general liability insurance, workers’ compensation, and auto insurance for project vehicles.

- Review Equipment Warranties. You have to know what is the lifespan of a solar panel in order to weigh your options. Usually, solar panels are able to function properly for 25-30 years, so look for at least 10-year inverter warranties and 25-year panel warranties to ensure coverage over the equipment’s lifetime. The installer should also provide you with a workmanship warranty.

- Research Panel Efficiency. Compare solar panel brands and model specifications to ensure optimal efficiency and durability. Also, you could never go wrong asking around for advice on how to test solar panels upon installation so you’d immediately be aware if there’s any problem with the system.

- Check Reviews and Ratings. Review sites to see satisfaction ratings for Pennsylvania solar companies.

- Consider Local Firms. Choose a company located near you for proximity, service availability, and familiarity with PA building codes.

Taking time to thoroughly vet solar providers helps ensure you get the best value from Pennsylvania solar incentives. Partner with an experienced local company for smooth permitting, installation, and activation.

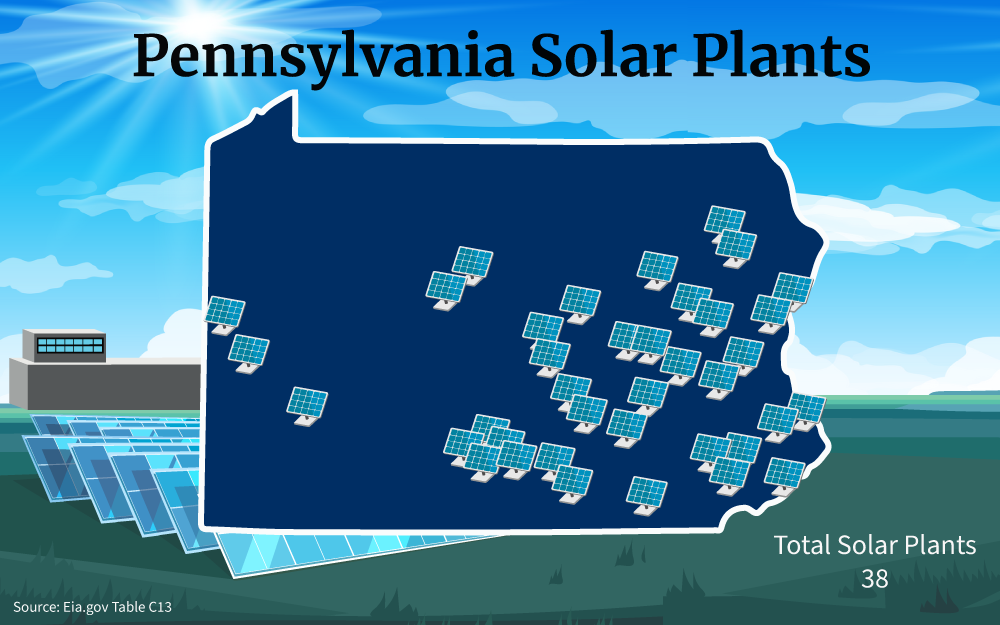

Solar Plants in Pennsylvania

Contributing significantly to the state’s renewable energy landscape are solar farms in Pennsylvania that have been steadily growing in number and size over the years.

These solar farms play a pivotal role in achieving Pennsylvania’s goal of reducing its carbon footprint and combating climate change. Not only do they generate clean energy, but they also create jobs, stimulate economic growth, and reduce greenhouse gas emissions.

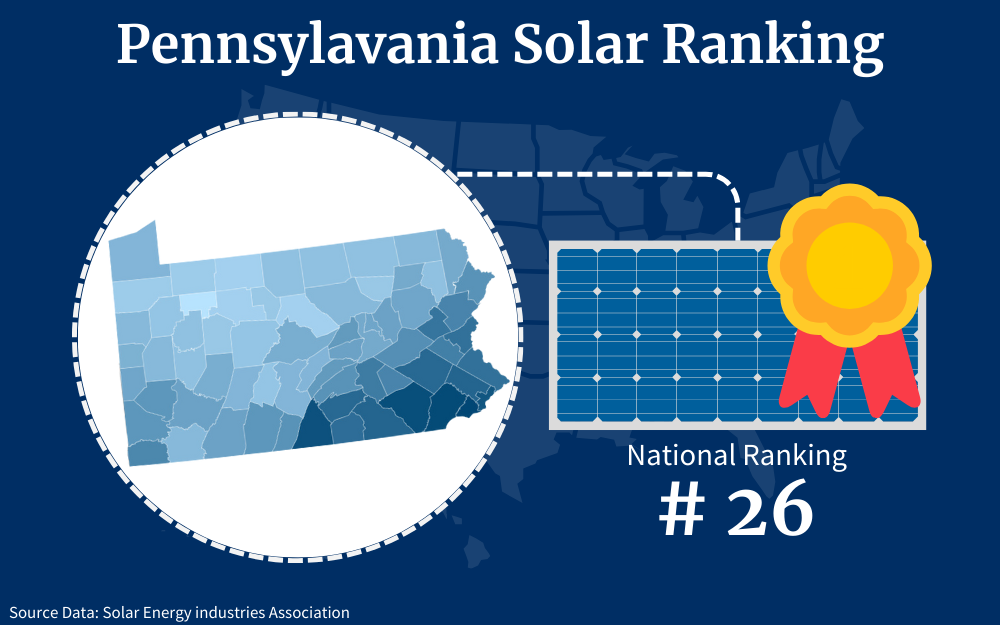

Currently, Pennsylvania’s solar market is ranked 26th in the country, so there has never been a better time to switch to solar in the Keystone State. Although it doesn’t offer state tax credits, the combination of the 30% federal credit, SRECs, net metering, and local rebates in some areas can add up to thousands in savings.

And, with solar panel costs steadily decreasing each year, you get even more bang for your buck. Plus, once your system is paid off you get 10-15 years of practically free electricity from the sun. Not to mention you’re reducing your environmental impact.

So, how do you start this process? Connect with a top-rated local solar installer near you. They’ll guide you through qualifying for every possible incentive and credit to maximize your value. They’ll also handle system design, permitting, installation, and activation, so you can start pumping out clean energy.

With all of the Pennsylvania solar incentives available, now is a perfect time to make the switch and take control of your electricity bills while moving to a smarter, cleaner energy source.

Frequently Asked Questions About Pennsylvania Solar Incentives

What's the Typical Cost of Going Solar in Pennsylvania?

For a standard 6 kW system, you’ll usually pay $18,000 – $22,000 before tax credits and incentives. The federal solar tax credit can reduce this cost by $5,000 – $6,600 to around $13,500 on average. Other incentives such as SRECs and Net Metering can also bring this cost lower in the long term.

How Many Years Until Solar Pays Off in PA?

With electric rates and incentives here, most solar panel systems take 6-9 years to pay off. After you hit that break-even point, your solar array will continue producing free electricity for 10-15 more years with very minimal overheads.

What Are These SRECs I Keep Hearing About?

SRECs stand for solar renewable energy certificates. For every 1,000 kWh your panels produce, you earn one SREC. You can then sell these certificates to utility companies for around $30-50 each. It’s a nice little annual bonus check from your solar system!

References

1Brill, R., & Ogletree, A. (2023, September 12). How Much Do Solar Panels Cost In 2023? Forbes. Retrieved September 13, 2023, from <https://www.forbes.com/home-improvement/solar/cost-of-solar-panels/>

2Internal Revenue Service. (2022). Residential Energy Credits. Internal Revenue Service. Retrieved September 13, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

3North American Board of Certified Energy Practitioners. (2023). Certifications. NABCEP. Retrieved September 13, 2023, from <https://www.nabcep.org/certifications/>

4Pennsylvania Department of Environmental Protection. (2013). Pennsylvania Sunshine Guidelines for the Residential and Small Business Solar Program. Pennsylvania Department of Environmental Protection. Retrieved September 13, 2023, from <https://files.dep.state.pa.us/energy/Office%20of%20Energy%20and%20Technology/OETDPortalFiles/GrantsLoansTaxCredits/Solar/Pa%20Sunshine%20Guidelines.pdf>

5Pennsylvania Department of Environmental Protection. (2023). PA Sunshine Program. Pennsylvania Department of Environmental Protection. Retrieved September 13, 2023, from <https://files.dep.state.pa.us/energy/energy%20independence/energyindportalfiles/solar/PA%20Sunshine%20Program_Double%20dipping.pdf>

6Pennsylvania Housing Finance Agency. (2023). Homeowners Energy Efficiency Loan Program (HEELP). Pennsylvania Housing Finance Agency. Retrieved September 13, 2023, from <https://www.phfa.org/programs/heelp.aspx>

7Pennsylvania Public Utility Commission. (2023). AEPS Act. Pennsylvania Public Utility Commission. Retrieved September 13, 2023, from <https://www.puc.pa.gov/filing-resources/issues-laws-regulations/aeps-act/>

8Philadelphia City Government. (2023). Philadelphia Solar Rebate. Philadelphia City Government. Retrieved September 13, 2023, from <https://www.phila.gov/programs/solar-rebate-program/>

9Philadelphia Energy Authority. (2023). Solarize Philly. Philadelphia Energy Authority. Retrieved September 13, 2023, from <https://philaenergy.org/programs-initiatives/solarize-philly/>

10PJM Environmental Information Services. (2023). About GATS. PJM Environmental Information Services. Retrieved September 13, 2023, from <https://www.pjm-eis.com/getting-started/about-GATS.aspx>

11U.S. Department of Energy. (2021, August 31). Decisions, Decisions: Choosing the Right Solar Installer. Energy.gov. Retrieved September 13, 2023, from <https://www.energy.gov/eere/solar/articles/decisions-decisions-choosing-right-solar-installer>

12U.S. Department of Energy. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Energy.gov. Retrieved September 13, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

13U.S. Energy Information Administration. (2023). Table 5.6.A. Average Price of Electricity to Ultimate Customers by End-Use Sector. U.S. Energy Information Administration. Retrieved September 13, 2023, from <https://www.eia.gov/electricity/monthly/epm_table_grapher.php?t=epmt_5_6_a>

14Wood, D. (2014, November 10). How Much Energy Does Your State Produce? Energy.gov. Retrieved September 13, 2023, from <https://www.energy.gov/articles/how-much-energy-does-your-state-produce>

15Photo by MariaGodfrida. Pixabay. Retrieved from <https://pixabay.com/photos/solar-panels-green-power-944013/>

16Screenshot of IRS Form 5695. Internal Revenue Service. Retrieved from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>